The first pharma agent

Why the first pharma agent is an analyst for due diligence

Less than 8% of drugs succeed through clinical trials to make it to the doctor’s office or pharmacy. Each failure means lost time, burned capital, and another therapy that never reaches patients.

In the rare cases that a drug makes it to market, it takes on average 10 years and $2.5B end to end. (Source: WHO; Nature Reviews Drug Discovery, 2025). Few sectors are as ripe for change as this $276B/year niche that feeds into the $1.7 Trillion/year pharmaceuticals market. So where do we begin?

Every transformation has a first step. Not the biggest step. The most constrained one.

The first pharma agent will not discover a molecule. It will not replace a scientist. It will not run a company. It will do something much smaller and much more important. It will read.

The real bottleneck

Pharma today is not limited by intelligence. It is limited by fragmentation.

A single clinical program generates tens of thousands of documents. Protocols. SAPs. Clinical study reports. Regulatory letters. Internal decks. They live in different systems, owned by different teams. No single human ever sees the full picture.

The cost is real. Clinical teams spend 30 to 40 percent of their time searching for and reconciling information. Not analyzing it. Senior leaders rely on summaries that are outdated, filtered, and incomplete. Critical assumptions are lost or contradicted without being noticed.

A Day in the Life of a Biotech Leader isn’t Pretty:

A reader and a unifier

The first pharma agent is a reader and unifier. More precisely, an analyst for due diligence. Its role is not creativity or discovery, but judgment support at the moments that matter most in clinical development.

It does not replace decision makers. It improves the quality of their decisions.

The agent begins with relevance driven retrieval, identifying the right trials, comparators, and historical precedents. It then reads across the full program as a system spanning science, trial design, regulation, operations, and competition, focusing not on volume but on alignment.

Dimensional Analysis

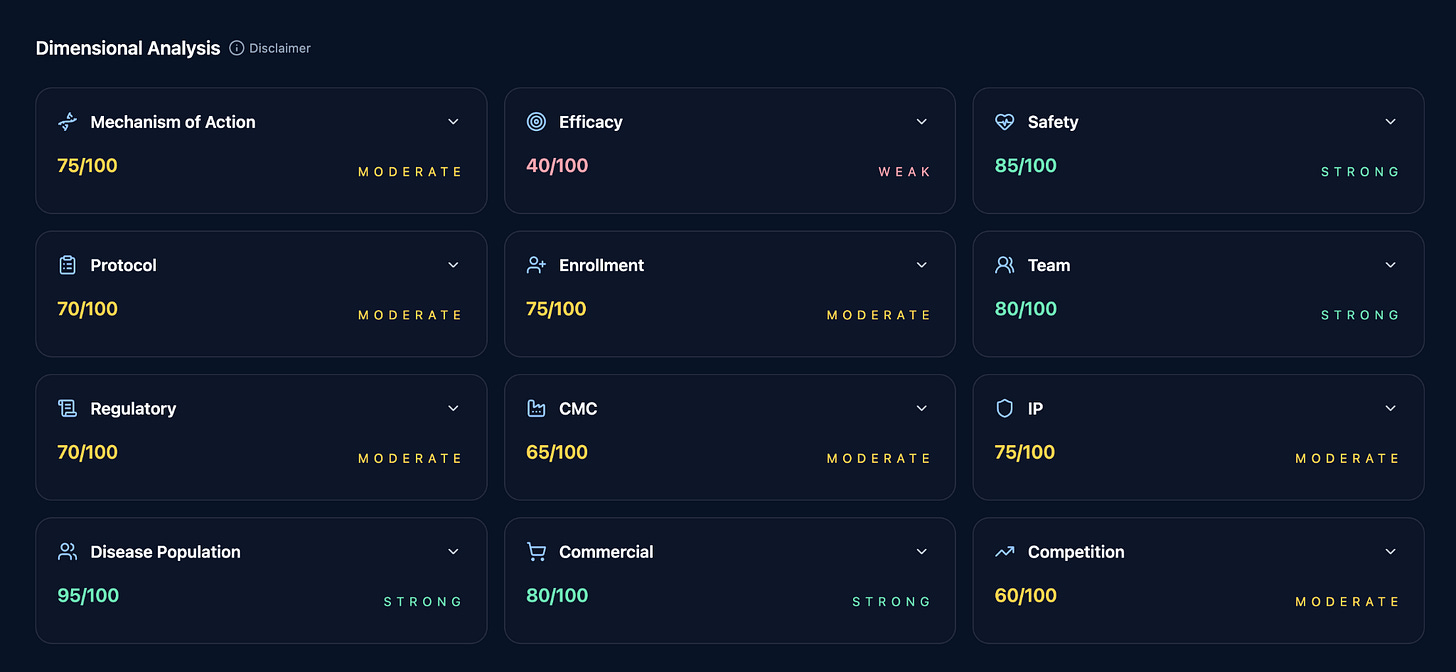

This analysis is structured through the twelve dimensions of clinical trial success. Mechanism of action, efficacy, safety, and disease population form the scientific core. Protocol quality, enrollment strength, and clinical team capability define the operational center. Regulatory path, CMC readiness, intellectual property, competitive landscape, and commercial viability connect the program to the external world.

Each dimension matters on its own. What matters more is how they interact.

A workflow of agents concurrently calls the core database retrieves dimension specific data and runs a cascade of analytical algorithms to score it.

From structure to score

The agent does not turn this into a narrative. It turns it into scores. Each dimension is evaluated independently, then benchmarked against an underlying dataset of real programs. Successes. Failures. Near misses. False confidence. Unexpected wins.

Weaknesses surface even when the commercial opportunity looks strong.

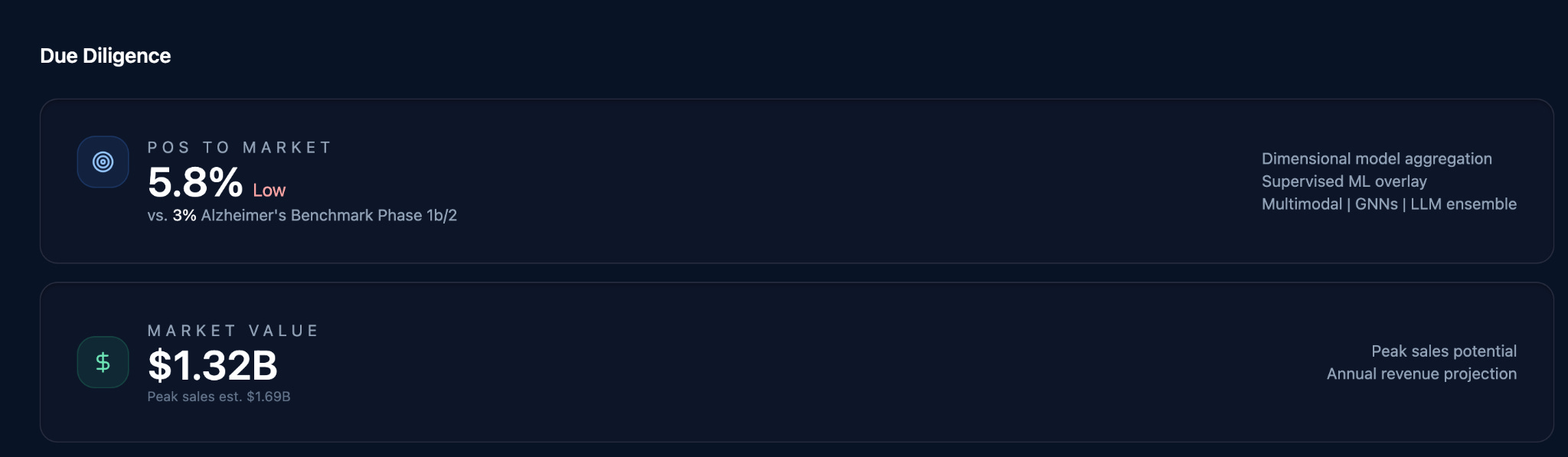

From this structured analysis comes the output every investment committee, portfolio review, and development decision ultimately seeks. Probability of success.

This is the core due diligence task in pharma. Everything else follows from it.

Once probability is established, value can be modeled. The agent performs market analysis, builds pricing and adoption assumptions, constructs discounted cash flow models, and runs sensitivity analyses.

It produces the same artifacts humans already use. Models. Spreadsheets. Explicit assumptions. Transparent logic. Nothing is hidden. Nothing is implied.

Human judgment remains

Humans remain fully accountable. They challenge the inputs. They adjust the assumptions. They override the conclusions when judgment demands it.

What changes is not who decides, but how informed that decision is.

This is the first pharma agent. Not a scientist. Not an executive. A due diligence agent. This is where autonomous pharma actually begins.

How it all comes together: