In 10-15 years, pharma will look like this

A new stack for pharma

In 10-15 years, pharma will look like this.

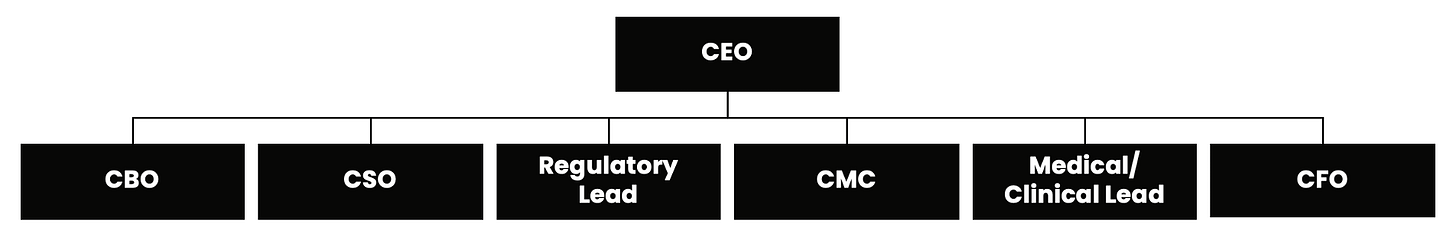

As a Full Stack AI Pharma Company, the majority of core functions of clinical trials will be run by specialized AI agents across science, regulatory, clinical, and commercial workflows. Each agent handles a distinct domain, from mechanism-of-action analysis to protocol design to CMC and portfolio strategy. Together they operate as an autonomous layer that reduces risk, and scales pharma value for patients.

Only 7 human leaders will be needed to run a $100B pharma.

Their workflows will not be fully run by agents, but rather with agents. The key is that these workflows must be automatable. Each step in a clinical trial follows a pattern that can be learned, modeled, and executed by an agent that specializes in that domain. Human leaders set direction, make final judgments, and guide strategy, while agents perform the continuous analysis, monitoring, forecasting, and decision support that no human team can sustain at scale. The agents do the work that is repeatable and data driven. The humans do the work that is creative and strategic. Together they form a new operating model for pharma.

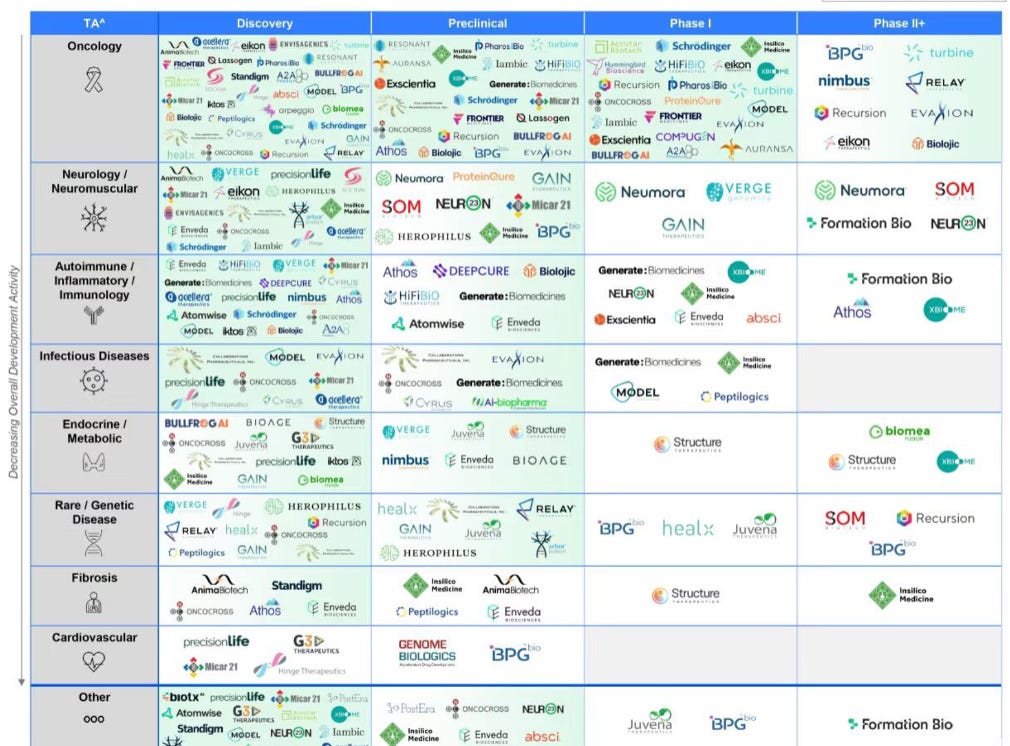

Currently, the majority of the focus in AI for Pharma is not here. It is in drug discovery. Everyone I know is in this space. It is like a gold rush for gold.

You can see how little white space exists in discovery and preclinical. When I say white space, I quite literally mean white space on the page of the market map!

Yes, the AI drug discovery boom has created a new problem. Discovery is now crowded. Many great molecules are here already, and many great ones are coming as dozens of platforms compete intensely across every therapeutic area. Oncology, neurology, autoimmune, infectious disease, metabolic, rare disease, and more will see a new revolution.

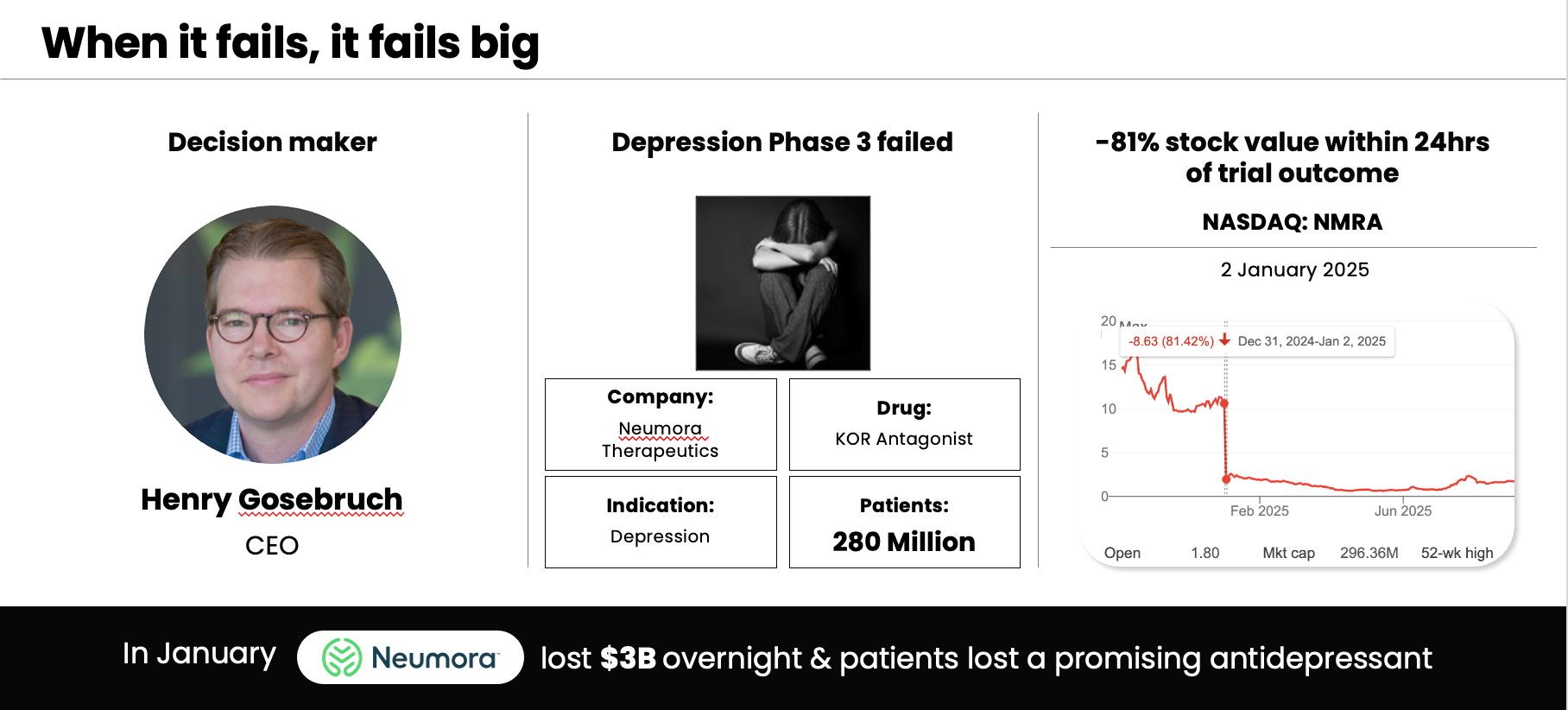

Yet even with all this innovation, good molecules still fail in clinical trials. This is why a new layer. One that determines which molecules actually make it to patients. And helps the molecules go through the clinical stage, not just discovery stage.

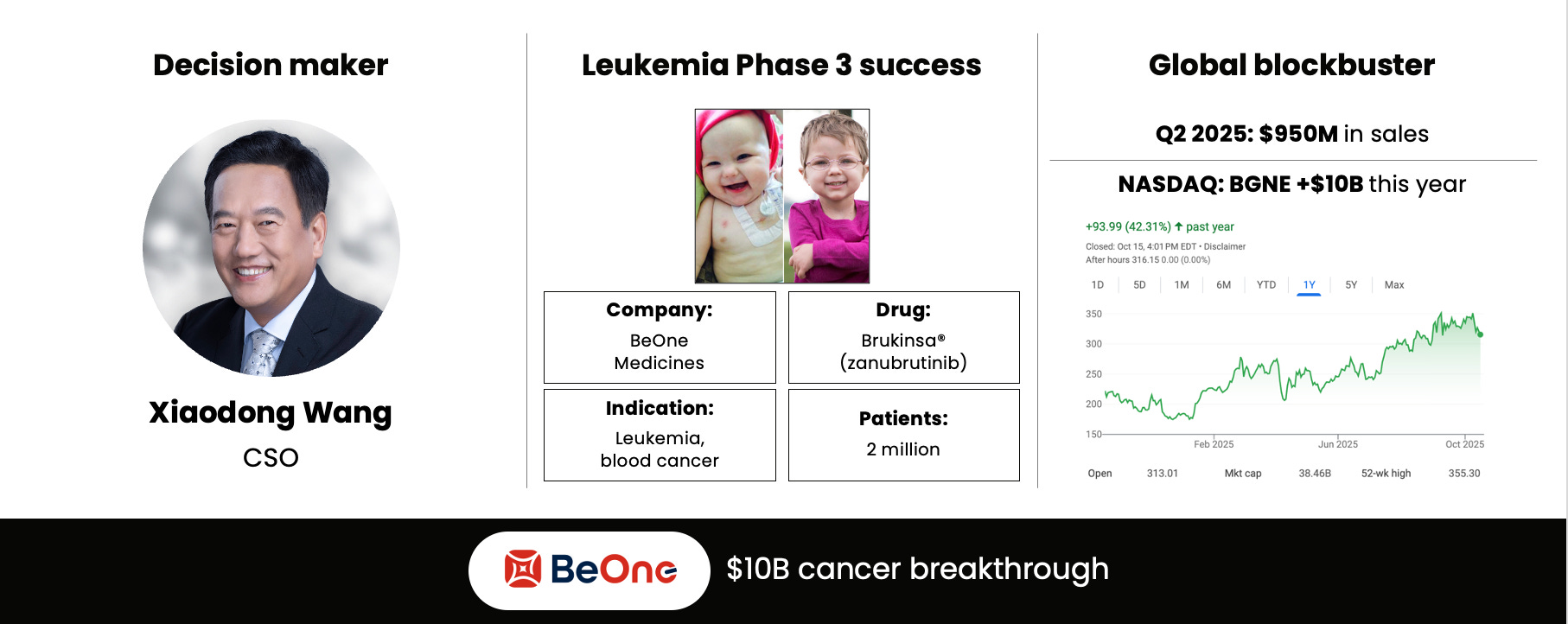

It is true that only 8% of clinical trial programs take a drug to market. It takes on average 10 years and $2.5B end to end. When it works, it works big:

But these are the rare 8% that succeed. Every domain and dimension has to line up. The domains of science, regulatory, commercial, and trial operations have to be

flawless. And the twelve dimensions have to work out.

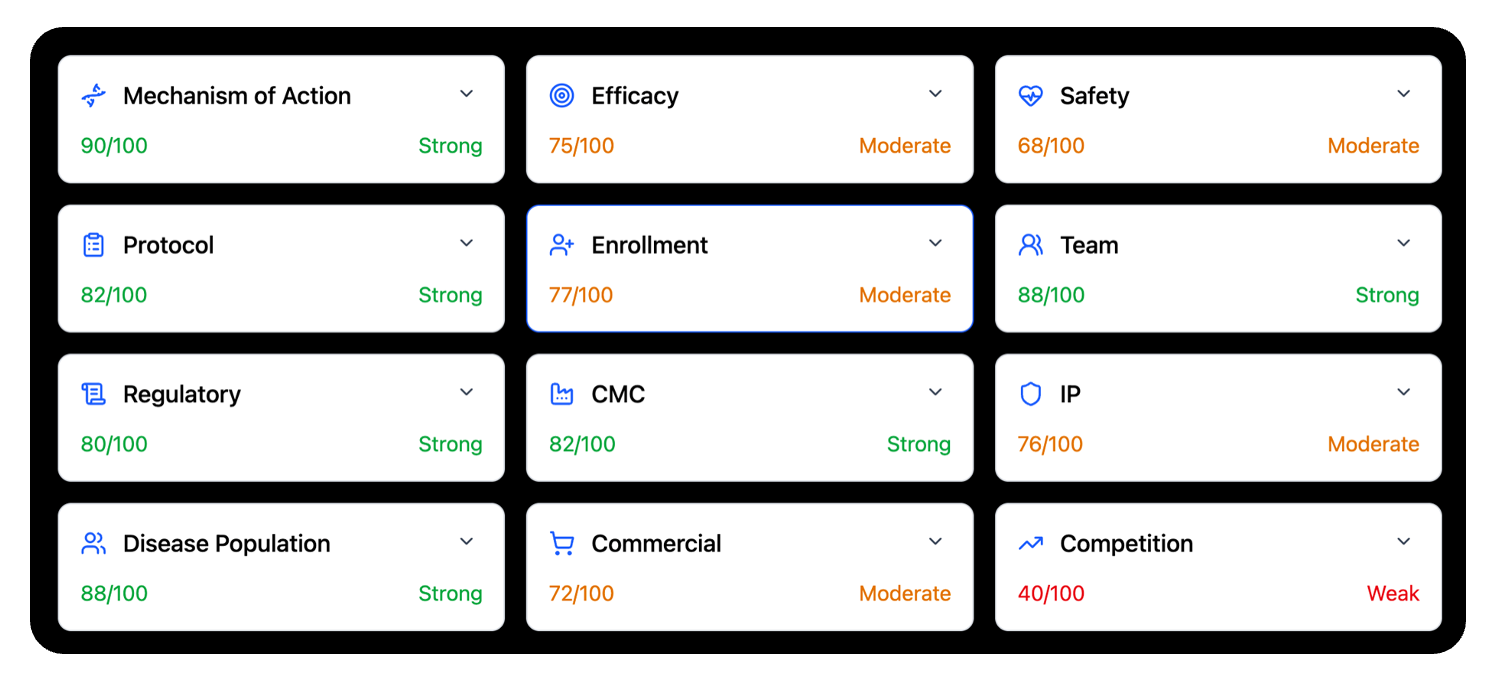

The twelve dimensions of a clinical trial capture the full reality of drug development. They span the scientific core, such as mechanism of action, efficacy, safety, disease population, and CMC. They include the operational center of gravity, such as protocol quality, enrollment strength, and the capability of the clinical team. And they extend into the external world, such as regulatory strategy, commercial viability, intellectual property strength, and the competitive landscape. These dimensions form the true map of risk. Each one can move a program forward or hold it back. Each one matters.

What makes these twelve dimensions powerful is their interdependence. A program can have strong biology but weak enrollment. It can have a strong protocol but an unclear regulatory path. It can have encouraging efficacy signals but face a crowded competitive field. A single weakness can cascade across the rest of the system until it limits the probability of success. This is why trial outcomes are rarely the result of a single factor. They emerge from the interaction of all twelve. Only when every dimension aligns do programs rise into the small group that reaches patients.

A weakness in any one of these areas can cascade into failure, even when the science and team are strong. This is why one mistake in one dimension is often enough to put a program into the 92% of trials that fail.

Pharma is actually changing much faster than people think, and much further beyond early stage drug discovery. The clinical stage is changing, too.

And the reason is simple: the problem in drug development is no longer the lack of data; it’s the lack of integrated intelligence to turn that data into decisions.

Clinical trial intelligence 101

Clinical trial intelligence creates a complete and structured view of a trial. It pulls together every document, every past study, every regulatory precedent, every biomarker dataset, every safety signal, every competitive readout, every dosing pattern, and every patient population variable. It then transforms this chaos into a unified and interpretable model of the trial. Instead of scattered PDFs and siloed experts, teams get an integrated map of risk across science, clinical strategy, regulatory pathways, and commercial positioning. Clinical trial intelligence is what finally connects the dots.

Once the data is structured, the system begins to reason. It analyzes each of the twelve dimensions of trial success, quantifies their strength, predicts where failure is most likely to emerge, and benchmarks every decision against historical analogs across thousands of programs. It runs counterfactual scenarios. How would success probabilities change if inclusion criteria shifted. If endpoints changed. If CMC timelines slipped. If the competitive landscape evolved mid trial. This gives leaders something they have never had before. Early visibility into failure before it happens, and a probabilistic explanation of why.

And finally, clinical trial intelligence intervenes. It recommends specific protocol refinements, enrollment adjustments, safety mitigations, statistical design improvements, regulatory strategies, site mixes, and even portfolio sequencing. It identifies the weakest dimension, explains the root cause, and suggests the corrective action with the highest expected value. Instead of discovering problems at interim analysis after millions are spent, trial intelligence surfaces them at the design stage when they are still solvable. The outcome is simple but transformative. Fewer preventable failures, more successful programs, and more molecules that actually make it to patients.

A new stack is emerging.

And the impact will be enourmous.

The power of one percent

A one percent increase in clinical trial success may sound small, but in the $1.7 Trillion pharmaceuticals industry it is indeed enormous. One percent more programs reaching approval translates into one hundred seventy billion dollars in new annual value for the industry. It also means more therapies reaching the people who need them. For cancer patients, for people with neurodegenerative disease, for families living with rare disorders, that one percent is not a statistic. It is time. It is survival. It is the difference between a pipeline that stalls and a pipeline that delivers. A one percent improvement reshapes the economics of pharma, but it also reshapes lives.

The real winners in the gold rush

The current boom in AI for drug discovery feels a lot like a gold rush. Everyone is rushing into the mountains, digging for new molecules, believing that the next strike will change everything. But in every gold rush, the real winners were the ones who looked ahead to the next part of the value chain. The ones who built the railroads, the banks, the equipment, the infrastructure that turned raw discoveries into lasting value. Discovery is the digging. Clinical trial intelligence is the infrastructure that determines which discoveries become real medicines.

In 10-15 years, pharma will look like this. The advent of autonomous pharma can be accelerated by about 5 years at most by the right company, the right team, and the right set of decisions. It will inevitably by here by 2040. But it can come sooner in the 2030s with the right push by the right people.

****

Wong, C. H., Siah, K. W., & Lo, A. W. (2019). Estimation of clinical trial success rates and related parameters. Biostatistics.

https://doi.org/10.1093/biostatistics/kxx069

DiMasi, J. A., Grabowski, H. G., & Hansen, R. W. (2016). Innovation in the pharmaceutical industry: New estimates of R&D costs. Journal of Health Economics.

https://doi.org/10.1016/j.jhealeco.2016.01.012